Predictions: Tech Trends – part 1 – 2014

RFG Perspective: The global economic headwinds in 2014, which constrain IT budgets, will force IT executives to question certain basic assumptions and reexamine current and target technology solutions. There are new waves of next-generation technologies emerging and maturing that challenge the existing status quo and deserve IT executive attention. These technologies will improve business outcomes as well as spark innovation and drive down the cost of IT services and solutions. IT executives will have to work with business executives fund the next-generation technologies or find self-funding approaches to implementing them. IT executives will also have to provide the leadership needed for properly selecting and implementing cloud solutions or control will be assumed by business executives that usually lack all the appropriate skills for tackling outsourced IT solutions.

As mentioned in the RFG blog "IT and the Global Economy – 2014" the global economic environment may not be as strong as expected, thereby keeping IT budgets contained or shrinking. Therefore, IT executives will need to invest in next-generation technology to contain costs, minimize risks, improve resource utilization, and deliver the desired business outcomes. Below are a few key areas that RFG believes will be the major technology initiatives that will get the most attention.

Source: RFG

Analytics – In 2014, look for analytics service and solution providers to boost usability of their products to encompass the average non-technical knowledge worker by moving closer to a "Google-like" search and inquiry experience in order to broaden opportunities and increase market share.

Big Data – Big Data integration services and solutions will grab the spotlight this year as organizations continue to ratchet up the volume, variety and velocity of data while seeking increased visibility, veracity and insight from their Big Data sources.

Cloud – Infrastructure as a Service (IaaS) will continue to dominate as a cloud solution over Platform as a Service (PaaS), although the latter is expected to gain momentum and market share. Nonetheless, Software as a Service (SaaS) will remain the cloud revenue leader with Salesforce.com the dominant player. Amazon Web Services will retain its overall leadership of IaaS/PaaS providers with Google, IBM, and Microsoft Azure holding onto the next set of slots. Rackspace and Oracle have a struggle ahead to gain market share, even as OpenStack (an open cloud architecture) gains momentum.

Cloud Service Providers (CSPs) – CSPs will face stiffer competition and pricing pressures as larger players acquire or build new capabilities and new, innovative open-source based solutions enter the new year with momentum as large, influential organizations look to build and share their own private and public cloud standards and APIs to lower infrastructure costs.

Consolidation – Data center consolidation will continue as users move applications and services to the cloud and standardized internal platforms that are intended to become cloud-like. Advancements in cloud offerings along with a diminished concern for security (more of a false hope than reality) will lead to more small and mid-sized businesses (SMBs) to shift processing to the cloud and operate fewer internal data center sites. Large enterprises will look to utilize clouds and colocation sites for development/test environments and handling spikes in capacity rather than open or grow in-house sites.

Containerization – Containerization (or modularization) is gaining acceptance by many leading-edge companies, like Google and Microsoft, but overall adoption is slow, as IT executives have yet to figure out how to deal with the technology. It is worth noting that the power usage effectiveness (PUE) of these solutions is excellent and has been known to be as low as 1.05 (whereas the average remains around 1.90).

Data center transformation – In order to achieve the levels of operational efficiency required, IT executives will have to increase their commitment to data center transformation. The productivity improvements will be achieved through the use of the shift from standalone vertical stack management to horizontal layer management, relationship management, and use of cloud technologies. One of the biggest effects of this shift is an actual reduction in operations headcount and reorientation of skills and talents to the new processes. IT executives should look for the transformation to be a minimum of a three year process. However, IT operations executives should not expect clear sailing as development shops will push back to prevent loss of control of their application environments.

3-D printing – 2014 will see the beginning of 3-D printing taking hold. Over time the use of 3-D printing will revolutionize the way companies produce materials and provide support services. Leading-edge companies will be the first to apply the technology this year and thereby gain a competitive advantage.

Energy efficiency/sustainability – While this is not new news in 2014, IT executives should be making it a part of other initiatives and a procurement requirement. RFG studies find that energy savings is just the tip of the iceberg (about 10 percent) that can be achieved when taking advantage of newer technologies. RFG studies show that in many cases the energy savings from removing hardware kept more than 40 months can usually pay for new better utilized equipment. Or, as an Intel study found, servers more than four years old accounted for four percent of the relative performance capacity yet consumed 60 percent of the power.

Hyperscale computing (HPC) – RFG views hyperscale computing as the next wave of computing that will replace the low end of the traditional x86 server market. The space is still in its infancy, with the primary players Advanced Micro Devices (AMD) SeaMicro solutions and Hewlett-Packard's (HP's) Moonshot server line. While penetration will be low in 2014, the value proposition for HPC solutions should be come evident.

Integrated systems – Integrated systems is a poorly defined computing technology that encompasses converged architecture, expert systems, and partially integrated systems as well as expert integrated systems. The major players in this space are Cisco, EMC, Dell, HP, IBM, and Oracle. While these systems have been on the market for more than a year now, revenues are still limited (depending upon whom one talks to, revenues may now exceed $1 billion globally) and adoption moving slowly. Truly integrated systems do result in productivity, time and cost savings and IT executives should be piloting them in 2014 to determine the role and value they can play in the corporate data centers.

Internet of things – More and more sensors are being employed and imbedded in appliances and other products, which will automate and improve life in IT and in the physical world. From an data center information management (DCIM), these sensors will enable IT operations staff to better monitor and manage system capacity and utilization. 2014 will see further advancements and inroads made in this area.

Linux/open source – The trend toward Linux and open source technologies continues with both picking up market share as IT shops find the costs are lower and they no longer need to be dependent upon vendor-provided support. Linux and other open technologies are now accepted because they provide agility, choice, and interoperability. According to a recent survey, a majority of users are now running Linux in their server environments, with more than 40 percent using Linux as either their primary server operating system or as one of their top server platforms. (Microsoft still has the advantage in the x86 platform space and will for some time to come.) OpenStack and the KVM hypervisor will continue to acquire supporting vendors and solutions as players look for solutions that do not lock them into proprietary offerings with limited ways forward. A Red Hat survey of 200 U.S. enterprise decision makers found that internal development of private cloud platforms has left organizations with numerous challenges such as application management, IT management, and resource management. To address these issues, organizations are moving or planning a move to OpenStack for private cloud initiatives, respondents claimed. Additionally, a recent OpenStack user survey indicated that 62 percent of OpenStack deployments use KVM as the hypervisor of choice.

Outsourcing – IT executives will be looking for more ways to improve outsourcing transparency and cost control in 2014. Outsourcers will have to step up to the SLA challenge (mentioned in the People and Process Trends 2014 blog) as well as provide better visibility into change management, incident management, projects, and project management. Correspondingly, with better visibility there will be a shift away from fixed priced engagements to ones with fixed and variable funding pools. Additionally, IT executives will be pushing for more contract flexibility, including payment terms. Application hosting displaced application development in 2013 as the most frequently outsourced function and 2014 will see the trend continue. The outsourcing of ecommerce operations and disaster recovery will be seen as having strong value propositions when compared to performing the work in-house. However, one cannot assume outsourcing is less expensive than handling the tasks internally.

Software defined x – Software defined networks, storage, data centers, etc. are all the latest hype. The trouble with all new technologies of this type is that the initial hype will not match reality. The new software defined market is quite immature and all the needed functionality will not be out in the early releases. Therefore, one can expect 2014 to be a year of disappointments for software defined solutions. However, over the next three to five years it will mature and start to become a usable reality.

Storage - Flash SSD et al – Storage is once again going through revolutionary changes. Flash, solid state drives (SSD), thin provisioning, tiering, and virtualization are advancing at a rapid pace as are the densities and power consumption curves. Tier one to tier four storage has been expanded to a number of different tier zero options – from storage inside the computer to PCIe cards to all flash solutions. 2014 will see more of the same with adoption of the newer technologies gaining speed. Most data centers are heavily loaded with hard disk drives (HDDs), a good number of which are short stroked. IT executives need to experiment with the myriad of storage choices and understand the different rationales for each. RFG expects the tighter integration of storage and servers to begin to take hold in a number of organizations as executives find the closer placement of the two will improve performance at a reasonable cost point.

RFG POV: 2014 will likely be a less daunting year for IT executives but keeping pace with technology advances will have to be part of any IT strategy if executives hope to achieve their goals for the year and keep their companies competitive. This will require IT to understand the rate of technology change and adapt a data center transformation plan that incorporates the new technologies at the appropriate pace. Additionally, IT executives will need to invest annually in new technologies to help contain costs, minimize risks, and improve resource utilization. IT executives should consider a turnover plan that upgrades (and transforms) a third of the data center each year. IT executives should collaborate with business and financial executives so that IT budgets and plans are integrated with the business and remain so throughout the year.

Predictions: People & Process Trends – 2014

RFG Perspective: The global economic headwinds in 2014, which constrain IT budgets, will force business and IT executives to more closely examine the people and process issues for productivity improvements. Externally IT executives will have to work with non-IT teams to improve and restructure processes to meet the new mobile/social environments that demand more collaborative and interactive real-time information. Simultaneously, IT executives will have to address the data quality and service level concerns that impact business outcomes, productivity and revenues so that there is more confidence in IT. Internally IT executives will need to increase their focus on automation, operations simplicity, and security so that IT can deliver more (again) at lower cost while better protecting the organization from cybercrimes.

As mentioned in the RFG blog "IT and the Global Economy – 2014" the global economic environment may not be as strong as expected, thereby keeping IT budgets contained or shrinking. Therefore, IT executives will need to invest in process improvements to help contain costs, enhance compliance, minimize risks, and improve resource utilization. Below are a few key areas that RFG believes will be the major people and process improvement initiatives that will get the most attention.

Automation/simplicity – Productivity in IT operations is a requirement for data center transformation. To achieve this IT executives will be pushing vendors to deliver more automation tools and easier to use products and services. Over the past decade some IT departments have been able to improve productivity by 10 times but many lag behind. In support of this, staff must switch from a vertical and highly technical model to a horizontal one in which they will manage services layers and relationships. New learning management techniques and systems will be needed to deliver content that can be grasped intuitively. Furthermore, the demand for increased IT services without commensurate budget increases will force IT executives to pursue productivity solutions to satisfy the business side of the house. Thus, automation software, virtualization techniques, and integrated solutions that simplify operations will be attractive initiatives for many IT executives.

Business Process Management (BPM) – BPM will gain more traction as companies continue to slice costs and demand more productivity from staff. Executives will look for BPM solutions that will automate redundant processes, enable them to get to the data they require, and/or allow them to respond to rapid-fire business changes within (and external to) their organizations. In healthcare in particular this will become a major thrust as the industry needs to move toward "pay for outcomes" and away from "pay for service" mentality.

Chargebacks – The movement to cloud computing is creating an environment that is conducive to implementation of chargebacks. The financial losers in this game will continue to resist but the momentum is turning against them. RFG expects more IT executives to be able to implement financially-meaningful chargebacks that enable business executives to better understand what the funds pay for and therefore better allocate IT resources, thereby optimizing expenditures. However, while chargebacks are gaining momentum across all industries, there is still a long way to go, especially for in-house clouds, systems and solutions.

Compliance – Thousands of new regulations took effect on January 1, as happens every year, making compliance even tougher. In 2014 the Affordable Care Act (aka Obamacare) kicked in for some companies but not others; compounding this, the U.S. President and his Health and Human Services (HHS) department keep issuing modifications to the law, which impact compliance and compliance reporting. IT executives will be hard pressed to keep up with compliance requirements globally and to improve users' support for compliance.

Data quality – A recent study by RFG and Principal Consulting on the negative business outcomes of poor data quality finds a majority of users find data quality suspect. Most respondents believed inaccurate, unreliable, ambiguously defined, and disorganized data were the leading problems to be corrected. This will be partially addressed in 2014 by some users by looking at data confidence levels in association with the type and use of the data. IT must fix this problem if it is to regain trust. But it is not just an IT problem as it is costing companies dearly, in some cases more than 10 percent of revenues. Some IT executives will begin to capture the metrics required to build a business case to fix this while others will implement data quality solutions aimed at fixing select problems that have been determined to be troublesome.

Operations efficiency – This will be an overriding theme for many IT operations units. As has been the case over the years the factors driving improvement will be automation, standardization, and consolidation along with virtualization. However, for this to become mainstream, IT executives will need to know and monitor the key data center metrics, which for many will remain a challenge despite all the tools on the market. Look for minor advances in usage but major double-digit gains for those addressing operations efficiency.

Procurement – With the requirement for agility and the move towards cloud computing, more attention will be paid to the procurement process and supplier relationship management in 2014. Business and IT executives that emphasize a focus on these areas can reduce acquisition costs by double digits and improve flexibility and outcomes.

Security – The use of big data analytics and more collaboration will help improve real-time analysis but security issues will still be evident in 2014. RFG expects the fallout from the Target and probable Obamacare breaches will fuel the fears of identity theft exposures and impair ecommerce growth. Furthermore, electronic health and medical records in the cloud will require considerable security protections to minimize medical ID theft and payment of HIPAA and other penalties by SaaS and other providers. Not all providers will succeed and major breaches will occur.

Staffing – IT executives will do limited hiring again this year and will rely more on cloud services, consulting, and outsourcing services. There will be some shifts on suppliers and resource country-pool usage as advanced cloud offerings, geopolitical changes and economic factors drive IT executives to select alternative solutions.

Standardization –More and more IT executives recognize the need for standardization but advancement will require a continued executive push and involvement. In that this will become political, most new initiatives will be the result of the desire for cloud computing rather than internal leadership.

SLAs – Most IT executives and cloud providers have yet to provide the service levels businesses are demanding. More and better SLAs, especially for cloud platforms, are required. IT executives should push providers (and themselves) for SLAs covering availability, accountability, compliance, performance, resiliency, and security. Companies that address these issues will be the winners in 2014.

Watson – The IBM Watson cognitive system is still at the beginning of the acceptance curve but IBM is opening up Watson for developers to create own applications. 2014 might be a breakout year, starting a new wave of cognitive systems that will transform how people and organizations think, act, and operate.

RFG POV: 2014 will likely be a less daunting year for IT executives but people and process issues will have to be addressed if IT executives hope to achieve their goals for the year. This will require IT to integrate itself with the business and work collaboratively to enhance operations and innovate new, simpler approaches to doing business. Additionally, IT executives will need to invest in process improvements to help contain costs, enhance compliance, minimize risks, and improve resource utilization. IT executives should collaborate with business and financial executives so that IT budgets and plans are integrated with the business and remain so throughout the year.

Disrupt 2014

What did I learn (or what did you miss) at Disrupt 2014?

On Monday I attended The Robert Frances Group's (RFG) Disrupt 2014 conference in New York City. The attendees enjoyed an over-the-top lunch and several hours of interesting and informative presentations. I would probably gain weight just recounting the menu, so instead I'll review two of the presentations, and hint at a third.

1 - IT Disruptive Tech Trends and Directions

With this as the title, Cal Braunstein, CEO and Executive Director of Research for RFG, began by showing us how the pace of disruptive technology is increasing dramatically. According to AIIM, for more than 1/3 of the organizations studied, 90% of their IT spend adds no new value. It was the right start for Disrupt 2014.

IT budgets are increasing linearly, at 1-5% per year, while the data we produce is increasing exponentially. Disruption isn't just necessary, it is critical!

What is disruption? RFG defines it as industry leaders responding to the changes in customer demands and global economics by making fundamental changes in their approach to products, services, service delivery, engagement models, and the economic model on which their industry is based. You can read more about it here.

Cal focused on Storage Trends and Directions as a bellwether of disruption.

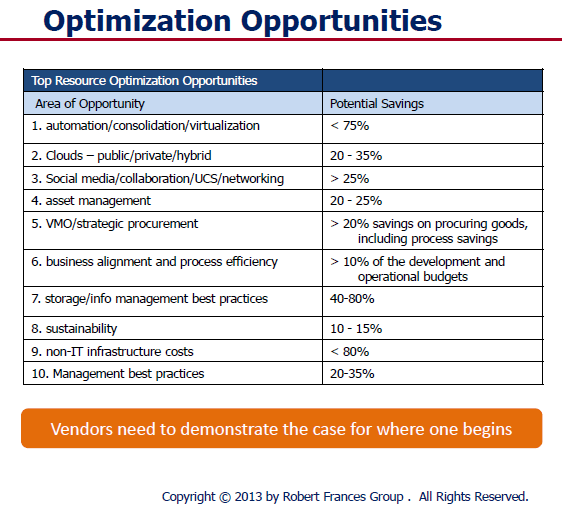

Intel conducted a study in 2012 that informed part of Cal's presentation. When looking at a data center and its technology, servers from before 2008 comprised 32% of the hardware but they consumed 60% of the data center power budget. Here is the bad news. The old gear only provided 4% of performance capacity. The point is that the technology rate of change is exponential and any IT executive that keeps IT hardware past 40 months is costing his company money. Keeping current and transforming the data center over a 3 year cycle should be viewed as a strategic approach to modernizing a data center and containing costs. The improvement in processing power vs. power consumed is truly disruptive. You could pay for a data center renewal simply by scrapping the old power burning gear. RFG has identified the following optimization opportunities, which Cal presented.

Intel conducted a study in 2012 that informed part of Cal's presentation. When looking at a data center and its technology, servers from before 2008 comprised 32% of the hardware but they consumed 60% of the data center power budget. Here is the bad news. The old gear only provided 4% of performance capacity. The point is that the technology rate of change is exponential and any IT executive that keeps IT hardware past 40 months is costing his company money. Keeping current and transforming the data center over a 3 year cycle should be viewed as a strategic approach to modernizing a data center and containing costs. The improvement in processing power vs. power consumed is truly disruptive. You could pay for a data center renewal simply by scrapping the old power burning gear. RFG has identified the following optimization opportunities, which Cal presented.

RFG has "Disrupt 2014" marching orders for IT

- IT departments must keep up with disruptive technologies

- Don't wait for next wave to become mainstream - the time to act is now

- IT vision and strategy must include waves of change

- IT needs business and user executives to share the vision, integrate & buy-in

- Data Center transformation is a must and has a very positive business case

- IT vendors must show a business case, not just talk about products & services

2 - The Value of TCO Studies

RFG Principal Analyst Gary McFadden presented on the value of Total Cost of Ownership (TCO) studies to support acquisition decisions. Gary's Disrupt 2014 thesis was straightforward. According to Gary...

RFG Principal Analyst Gary McFadden presented on the value of Total Cost of Ownership (TCO) studies to support acquisition decisions. Gary's Disrupt 2014 thesis was straightforward. According to Gary...

Businesses today are willing to invest provided they can see a decent return and a positive cost value proposition. Our TCO studies address the total cost of acquisition and ownership and the return on investment

In the RFG world, a TCO is a business-oriented custom research report that compares vendor offerings to those of their competitors. The report shows how the vendor's solution could be financially superior to traditional approaches, and considers soft-dollar aspects as well as hard costs.

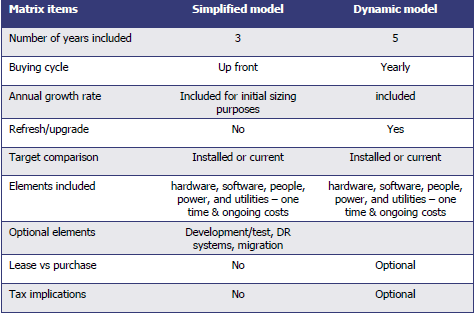

Knowing that, you should realize that all TCO studies are not created equal. Gary presented an overview of key TCO choices. Which one is right for you? Well, that depends on your needs. Your time horizon and buying cycle are chief determinants of which style of TCO would be right for you.

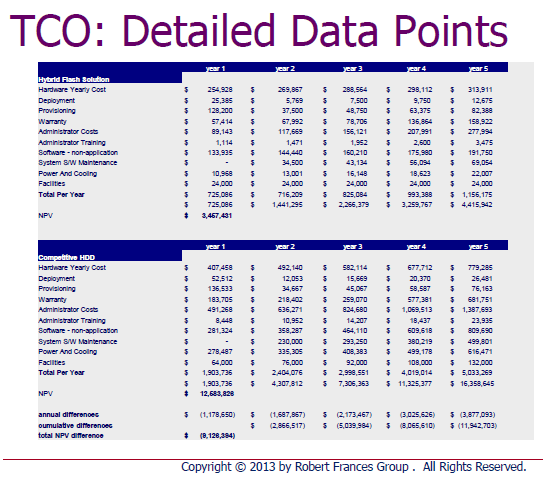

Making Sense of the Data

Gary correctly pointed out that no matter how comprehensive the data gathering phase of a TCO, the accumulated bulk of data is not actionable unless it is expressed in a useful manner. In the charts following, Gary contracted the details with an organized RFG presentation. The left chart holds mysteries, while the right one offers answers.

|

|

Remember that all TCOs are not created equal. Make sure that the one you pay for delivers the information you need, and the ones you use in your research follow a robust development methodology and contain the insights you require to enable your decision.

By the way, don't think RFG delivers vendor-slanted product and service stories. That is not what they are about. Instead, RFG's TCO reports are targeted at business and technology executives including CIOs, IT VPs/directors, CFOs, CMO, facilities executives, etc. They relate a business narrative designed to explain the business case for taking certain actions.

3 - Storm Insights "Mystery Presentation"

No, I can't tell you much. All I can say is that Dr. Adrian Bowles has an exciting and disruptive information services offering that will change the way IT product and services vendors learn about their markets, and the way their markets learn about them. Don't write off traditional research and advisory services yet, but stay tuned. I'll report about the Storm Insights offering as the new year unfolds. For now, take my word for it... this is very interesting!

The Bottom Line

Disrupt 2014 delivered great value and a great lunch to the appreciative attendees. RFG extended the hand of friendship and those that took hold learned much and enjoyed the sense of community that appears when like-minded professionals gather to exchange ideas. When RFG asks you to attend one of their meetings, the smart answer is "YES"!

Published by permission of Stuart Selip, Principal Consulting LLC